Return on Invested Capital (ROIC)

- Jagannath Kshtriya

- Oct 18, 2024

- 3 min read

Updated: Jan 7

Introduction

Efficient use of capital is key to creating value in a company. One of the most important metrics for this is Return on Invested Capital (ROIC), which shows how much profit a company makes for each dollar invested. Despite its importance, many companies don't prioritize improving their ROIC.

ROIC is a crucial factor in driving corporate performance and stock prices. While growth in revenue and profits also impact stock prices, ROIC is more important because it reflects how well a company turns capital into cash. Companies with higher ROIC are valued more highly by the market because they generate more cash per dollar invested.

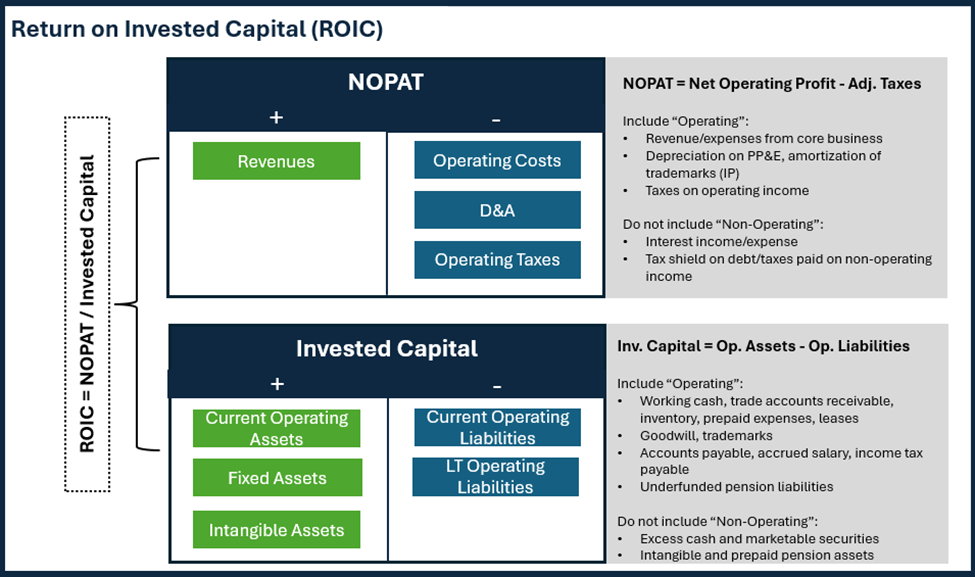

Calculating ROIC is fairly simple: ROIC = NOPAT / Average Invested Capital. NOPAT (Net Operating Profit After Tax) is a measure of a company's operating profit, while Invested Capital represents all the capital invested in the company over time.

How ROIC Benefits Investors

In basic terms, ROIC helps evaluate how efficiently a company’s management uses investor capital. However, it may not be the best way to compare companies across different industries since some industries require more capital than others.

If a company issued shares long ago at lower prices, its ROIC will be higher,

If a company has recently issued new shares at higher prices, its ROIC will be lower,

Companies with low debt tend to have a higher ROIC,

Companies with increasing debt, especially in a high-interest-rate environment, will see their ROIC decline.

Impact of Acquisitions and Write-Downs on ROIC

For the ROIC numerator, adjustments are made to calculate net operating profit after tax (NOPAT), excluding extraordinary items that may artificially inflate or reduce reported profits.

If a company raises capital to acquire other companies, its invested capital increases, and its ROIC may drop temporarily. The management expects these acquisitions to boost long-term profitability. However, if the company later writes down the value of the acquired assets (due to lower-than-expected performance), it may record a loss, temporarily lowering its ROIC. Once the assets are written down, they no longer count in the ROIC calculation, which can increase ROIC over time.

When assets are written down, they are removed from the balance sheet, and there is a charge on the income statement. However, some analysts adjust these numbers to keep the write-downs as part of the total invested capital. The true definition of invested capital is all the capital invested in the company over its lifetime, including any write-downs. Investors often look for accumulated write-downs, usually found in the notes of financial statements filed with regulators like the SEC.

Key Factors Investors Consider on ROIC

When assessing management’s focus on ROIC, investors look for key indicators:

Link to capital budgeting: Every capital allocation decision should meet the "Net Present Value" test, ensuring that ROIC exceeds the company’s Weighted Average Cost of Capital (WACC). This means that expected cash flows are sufficient to cover all costs, including the cost of equity.

ROIC as a value driver: ROIC plays a crucial role in driving enterprise value. Higher ROIC signals that the company is generating good returns from its investments.

Accurate ROIC calculation: To get a true picture of ROIC, investors need to carefully review the footnotes and management’s discussion and analysis (MD&A) in financial reports, as this is where important details are often hidden.

(Sources: MarketWatch, NewConstructs, ROIC PDF, Market, EnterpriseValue, InvestedCapital, NOPAT, Capital)

Comments